Wansteadium’s property blogger, George C Parker, writes:

Wansteadium’s property blogger, George C Parker, writes:

Gracious readers, Spring has arrived and the local property market continues to blossom. Increasingly I note that properties in this area are listed ‘sale by tender’. These three words are estate agent catnip – usually meaning that sealed bids are invited to avoid underpricing in a seller’s market.

An example is this handsome 5-bedder on Grove Park for which bids of around £1.3m are invited.

On offer are a very generous living area, and a mature, leafy garden-cum-cricket square in an excellent location. However, the successful bidder may choose to dispense with the rather trendy Dalston beard on the lower front bay window.

Alternatively, for those who would like yet another bedroom, plus walking access to stables, this Empress Avenue house is on the market with Churchills for a more transparent 900k.

Narnia in Aldersbrook

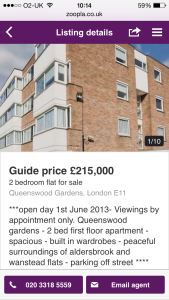

I needed a double-take when I spied this Martin and Co advert on Zoopla this morning. Were these Queenswood Gardens apartments truly “Built in wardrobes” like the fabled kingdom of C.S.Lewis? Perhaps when the Flats are snowy in winter, the residents might see a resemblance.

I needed a double-take when I spied this Martin and Co advert on Zoopla this morning. Were these Queenswood Gardens apartments truly “Built in wardrobes” like the fabled kingdom of C.S.Lewis? Perhaps when the Flats are snowy in winter, the residents might see a resemblance.

The comparison does pall somewhat when we remember that Narnia had a splendidly elegant lamp post. In contrast Redbridge appears to pride itself on finding the ugliest and ill-matched collection of street illumination outside of a war zone.

Returning to the property in question: with off-street parking, and directly on the 101 bus route to either Wanstead tube or Manor Park station, the price does begin to look extremely competitive (yes I did spot the reference to a June 2013 open day which I presume is a typo).

You’d probably get an even better view of Narnia might be afforded by this 5th floor residence in the little-known Belgrave Heights development.

Two wheels good

As anywhere in London, the ever-increasing number of new apartment buildings appears to be increasing the strain on infrastructure and services. Wansteadium has carried a number of articles on the increasing pressure on parking around homes, schools, and the High Street, and the difficulty in striking a happy medium.

Fundamentally there are too many short car journeys, yet Wanstead remains a truly wretched place to run a bicycle, not least for school kids who should be using their young legs rather than bouncing about in the back of cars.

I’m adding my two penny-farthings to this matter because there is solid evidence to suggest environmental, commercial and public health benefits to improving cycle access and storage facilities.

Thanks to Heather Whitney who posted an interesting article to the Wansteadium Facebook page recently.

Remember that local elections are coming up, so now is a good time to mention this and other issues (the state of Christchurch play area?) to your candidates as they attempt to canvass your endorsement. Like an estate agent: they work for you.

I see the Conservatives are fielding a priest; it’s come to that, lol

Sale by tender!

This is purely estate agents grabbing extra cash , charging the seller a nominal flat fee and then charging the buyer 2% , read the small print . Who would pay 2% to buy a house ? I certainly wouldn’t. I have recently sold my house (sub contract) why would I purchase SBT and pay 2 lots of estate agents fees . I made a point of not viewing any property’s that were up for sale with this scenario . It’s a con & should be nipped in the bud now. And with these charges who is the estate working on behalf of ? Conflicts of interest surely . It is this sort of practice that gives the estate agents the sort of unethical sleazy reputations of the past .

Mike

The seller suffers the fee always. It doesn’t matter who pays it in the first instance – buyer or seller – the net effect is that the seller has less cash than the buyer paid. Incidence is on the seller. It’s the same with stamp duty.

Fred

As the owner of a local estate agent I completely agree with the sentiments of Mike above. Sale by Tender is simply a way for certain estate agents to earn a much higher commission rate by exploiting the desperation of buyers who are finding themselves in a nightmare scenario of trying to purchase a property in the strongest sellers market ever.

The introduction fee or ransom is as much as 2% of the final selling price which is nearly double the average fee of estate agents locally. Sellers are lured in by the prospect of selling their property for £150 as the buyers will pay the fee. What is not mentioned is that the sellers lose half their market immediately as Mike says many buyers will not view properties that are sale by tender. It is also my view that inevitably the eventual buyer will view the property irrespective of the estate agent is is listed with. This unofficial tax restricts the budgets of the buyers and I think will ultimately affect negatively the final sale price. Also the fall through rate is extremely high as buyers carefully read the small print and realise the huge some of cash they need to find. Another factor is that any sales agreed nearing a stamp duty threshold this fee can take the price over as it is viewed as part of the purchase price.

I have been in the business for nearly 25 years and it is this sort of practice which continually damages the reputation of estate agents as a whole. I run a small business that survives on its reputation and I cannot afford to introduce such measures as today’s buyers are tomorrow’s sellers and such short sighted scams will come back to bite these greedy companies when the market turns.

That day I look forward to with relish.

It is wrong and needs to be dealt with swiftly.

John.

“June 2013 open day which I presume is a typoâ€

Michael Molloy Owner Martin & Co Wanstead –

Just to clarify – this was not a typo, last week Zoopla mistakenly uploaded a large number of properties that we had previously let and sold in the Wanstead/ Aldersbrook area back onto their portal. An IT glitch that they have now rectified.

As George C Parker correctly pointed out the property prices in Queenswood Gardens have risen significantly since June 2013, but the price increase does not appear to have put buyers off, we recently sold another property there with 37 viewings in one Saturday!

Another voice in agreement with both Mike and John Wagstaff regarding the outrageous practice of charging the buyer of the property the agent’s fee rather than the seller. I am shortly to put my own terraced property on the market with the intention (I use the word, as the prospect is daunting to say the least) of moving up the ladder to a larger (preferably detached) house in the immediate area. I did speak briefly with the particular agent who is operating this scam, who tried to fool me it was to my advantage. I explained that if I purchased a more expensive property through them on the same basis, it would cost me far more. He instantly floundered. I will not be using their services, and judging by their lack of homes for sale, nor are many others.

Just saw this also ,

http://www.itv.com/news/2014-05-09/the-growing-number-of-estate-agents-who-want-an-introduction-fee-from-house-buyers/

Whilst I appreciate your comments John, I refer you to the 9th May ITV interview with Christopher Hamer, the Property Ombudsman, above in the previous link who clearly expresses concerns regarding this practice and possible conflicts of interest. Also regarding sealed bids , this practice is widely used already on non sale for tender properties so irrelevant to , if anything this practice is taking 2% ( what I believe is normally charged to the buyer on S.b.T ) away from the sealed bid and so not available to the seller . I could sympathise better if a) the seller was not charged at all and b) the buyer was charged a fee that was more in line with what is the average negotiated fee in the normal market, however that aside when the status quo is changed in a marketplace it is invariably the consumer who loses out in the interim, until legislation is introduced. Let’s see what Mr Hamer’s finding are , and a word if caution too , these buyers introduction fees may have to be paid back in full or partially if his findings recommend so. As I have said previously , not for me thanks .

Regards

Mike

Mike, I respect your views. Just to clarify your point about “taking 2% away from the sealed bid and so not available to the seller” this is certainly not the case. We have conducted hundreds of sales via Sale by Tender and have achieved over 99% of the price on average so buyers are definitely not factoring in the introductionary fee when making offers. They realise only the very best price and being in the best position to proceed help will secure the property, both factors that are in the sellers best interests I am sure you would agree? Jon Holden

Whilst I fully accept the concerns that have been expressed on the subject of Sale by Tender and no one wants to put obstacles in the way of anyone striving to purchase a property, least of all estate agents, I would like the opportunity of responding to some of the comments made so far because I feel it important that people are aware of the facts in this matter.

The current market is quite unprecedented in the almost the 30 years I have worked in it. Annual price growth of 18% in London over the past year (source: Nationwide) is fueled by a severe shortage of properties coming on to the market. An example is if you are looking to buy a £400,000 property in Wanstead and your search takes 3 months, the property would have risen by £18,000. With an average of 53 buyers on our books for every property we have, competition is so huge that it takes some buyers 6 – 12 months to find a property during which time prices have risen substantinally.

What we have done by introducing Sale by Tender is to encourage more properties on to the market by taking away the hurdle of owners paying estate agency commission. The more properties that come on to the market, the more choice there is to satisfy demand and buyers are able to buy before prices increase even further. If buyers didn’t agree and didn’t want to pay an introductionary fee we wouldn’t have seen our new buyer resistrations increase by 23% over the 1st quarter of this year or reguarly attract 30+ viewers to our Open Houses on Saturdays.

In our experience Homeowners want to have as much money as possible to put towards their next purchase and having no agents commission to pay plus the benefit of achieving the maximum sale price through the sealed bid process helps them achieve this. Our Wanstead branch have many examples and evidence of this.

Just to clarify a couple of other points mentioned in this thread a) there is no conflict of interest – the owner is always our client, b) the buyers introductionary fee is not included in the purchase price and so does not affect stamp duty, c) there is no greater fall-off rate, buyers know the full details of SBT on every property advertised.

Jon Holden, Managing Director – Douglas Allen

Sorry John , But to say the 2% charge is not factored in is like saying the stamp duty costs are not factored in , of course they are! And whilst on the subject of 2% where did that figure come from , in my property sales over the last 10-15 years i have always negotiated commission, i think the average nowadays in most areas is probably 1% maybe 1.25% , how did you get to the figure of charging 2% , in fact can you tell me, with all sincerity, the last time you managed to charge an indivudual seller , not probate etc , a 2% fee ? or alternatively on non sale by tender properties you have listed what is the average fcommission charged at the moment across your offices ? One of your offices did my sale a quotation , it was nowhere near 2% to sell my house , and was open to negotiation to get the house on your books . The Ombudsman rightly points out that the prospective buyer is unable to negotiate this introductory buyer’s fee . He also mentions the possible conflict of interests . whichever way you spin it , you are earning 2% buyers fee in addition to charging the seller an administration fee, non SBT you wouldn’t have a hope in hell of getting that sort of commission. How, when more money is being taken in fee’s by the intermediary than in normal market practice, can you say you are working in the seller’s best interest and as someone i think pointed out earlier what happenns when that seller needs to buy they have paid you a nominal fee to sell and now get hit with a 2% fee to buy , how in any sense is that working in your clients interest.

Rant over , but come on , if the Ombudsman is investigating , how can you not be concerned about your practice?

Any guys reading this feel free to jump in anytime hehehe.

regards

Mike.

I’d like to thank all who have commented on the original piece, turning what was a two up two down of an article into a veritable mansion. At the same time I can’t believe that the central pillar of my prose, the mention of the horrendous lampposts, passed unremarked!